(Philippines, Indonesia, Vietnam & More)

If you work overseas in Singapore, UAE, Hong Kong, or Malaysia, you probably send money home every month.

But here’s the uncomfortable truth:

You might be losing $200–$800 every year in hidden remittance fees.

This guide breaks down:

- The cheapest way to send money to Southeast Asia

- Why traditional remittance companies are expensive

- How crypto (USDT) reduces fees dramatically

- What OFWs are starting to switch to

Let’s compare the real numbers.

- How Much Do You Actually Lose with Traditional Remittance?

- Why Remittance Fees Are So High in Southeast Asia

- A Growing Alternative: Sending USDT Instead of Cash

- Real Cost Comparison (Annual View)

- Is Crypto Remittance Safe?

- Why Southeast Asia Is Adopting Crypto Faster

- So… Is Crypto the Cheapest Way in 2026?

- What You Need to Get Started

How Much Do You Actually Lose with Traditional Remittance?

Most migrant workers use:

- Bank transfers

- Western Union

- Wise

- MoneyGram

At first glance, fees look small.

But there are 3 types of cost:

- Transfer fee

- FX spread (hidden exchange rate markup)

- Receiving bank charges

Example: Sending 0 to the Philippines

| Method | Total Cost | Time | Hidden FX Margin |

|---|---|---|---|

| Bank | $20–40 | 1–3 days | High |

| Western Union | $10–25 | Minutes–1 day | Medium |

| Wise | $5–15 | 1–2 days | Low |

| Crypto (USDT via TRC20) | $0.3–1 | 1–20 minutes | Almost none |

Now multiply that monthly.

$15 x 12 months = $180 per year.

For many OFWs, it’s even more.

Why Remittance Fees Are So High in Southeast Asia

Southeast Asia has:

- Large overseas workforce (especially Philippines)

- Weak banking access in rural areas

- Currency conversion dependency

- Multiple middlemen in transfers

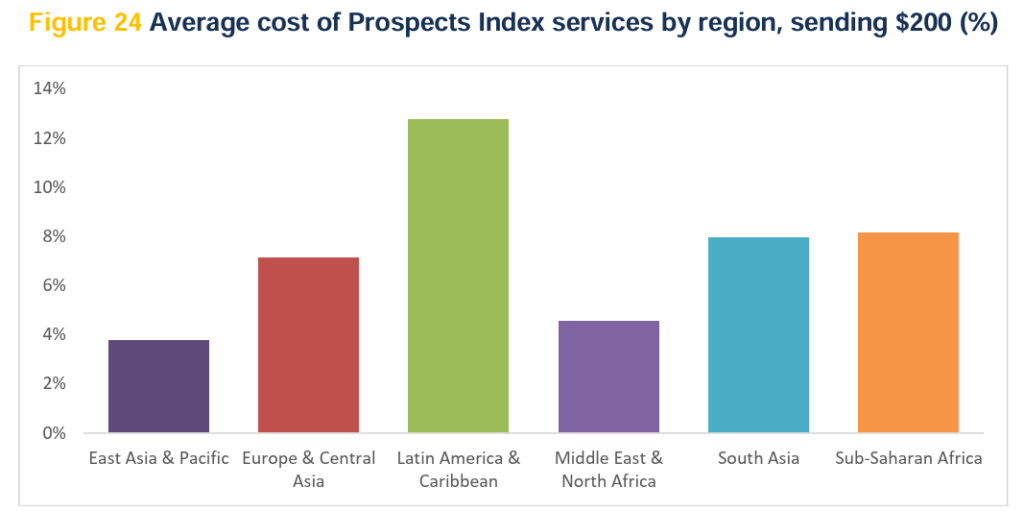

According to the World Bank, average global remittance fees are around 6%.

For a $500 transfer, that’s $30 lost.

For workers earning $1,500/month, that’s painful.

A Growing Alternative: Sending USDT Instead of Cash

Instead of converting USD → PHP (or IDR/VND) through banks, many migrant workers are switching to:

👉 Sending stablecoins like USDT

Here’s how it works:

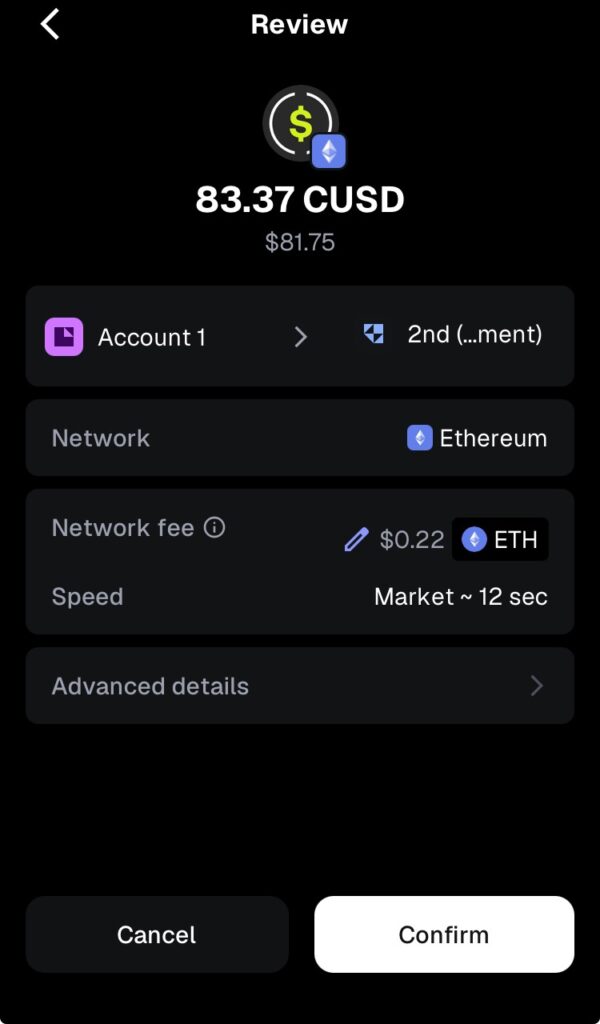

- Buy USDT on a crypto exchange

- Send it directly to your family’s wallet

- Transfer arrives in minutes

- Family can convert or spend digitally

Because USDT is pegged to USD:

- No FX volatility

- Very low blockchain transfer fee (TRC20 often <$1)

- No bank required

Real Cost Comparison (Annual View)

Let’s say you send $800/month home.

Using Traditional Services

Average total cost ≈ $25/month

Yearly = $300

Using Crypto (USDT TRC20)

Buy fee + withdrawal ≈ $0.3–1

Yearly = $12 max

Potential savings: $280+ per year

That’s a month of groceries in many Southeast Asian countries.

Is Crypto Remittance Safe?

Common concerns:

“What about volatility?”

Use USDT (stablecoin), not Bitcoin. As above mentioned, USDT is pegged to USD, so No bank required, No FX volatility and very low blockchain transfer fee (TRC20 often <$1).

“Is it legal?”

Crypto ownership is legal in most of Southeast Asia.

Regulations vary, but holding and sending stablecoins is generally permitted.

“Is it complicated?”

Not after the first setup.

Why Southeast Asia Is Adopting Crypto Faster

Southeast Asia consistently ranks high in crypto usage.

Countries like:

- Philippines

- Vietnam

- Indonesia

are among the top global adopters according to blockchain analytics reports.

Why?

- High remittance flow

- Young, mobile-first population

- Underbanked communities

- Expensive cross-border transfers

Crypto solves a real pain point here.

So… Is Crypto the Cheapest Way in 2026?

For many OFWs, yes.

Especially if:

- You send money monthly

- You send above $300 regularly(Of course, people sending less than $300 can also get benefit.)

- Your family doesn’t rely on physical cash only

However, this is not “crypto investing”.

This is optimized remittance.

What You Need to Get Started

- A crypto exchange account

- A USDT wallet

- Basic understanding of TRC20 network

In our next guide, we’ll show:

👉 Step-by-step: How OFWs can send USDT home safely

👉 Exact exchanges to use

👉 How families can receive and use it

Read the full step-by-step guide below.

First, open the crypto 2~3 crypto exchanges. Those offering the cheapest transfer fee and the best UI/UX are Bitget, MEXC and Bybit.

If you register those exchanges through below links, you can get bonus. Don’t forget to register from here. (Cuz I am an ambassador of these exchanges.)

Bitget

https://www.bitget.com/

コメント