For those who have followed Cattea since its Shanghai-mahjong-style Telegram game days, the launch of Catrix marks more than just a product expansion. It represents a structural evolution — from community-native mini-app to AI-powered perpetual trading infrastructure.

But for long-time community members, one question matters more than anything else:

Does using the Catrix AI Vault improve my positioning for $Bitcat?

Let’s break it down carefully.

The Evolution: Game to Financial Infrastructure

Cattea initially built a sizable Telegram-native audience through its interactive game mechanics. What often goes overlooked, however, is scale.

The public Telegram channel now approaches 200,000 members, with observed active counts exceeding 12,000 users simultaneously at times. In the Telegram ecosystem, that is not small.

Since January 2025, Cattea has transitioned into Catrix — a Perpetual DEX model enhanced with an AI Agent Vault.

Instead of farming in-game points, users can now:

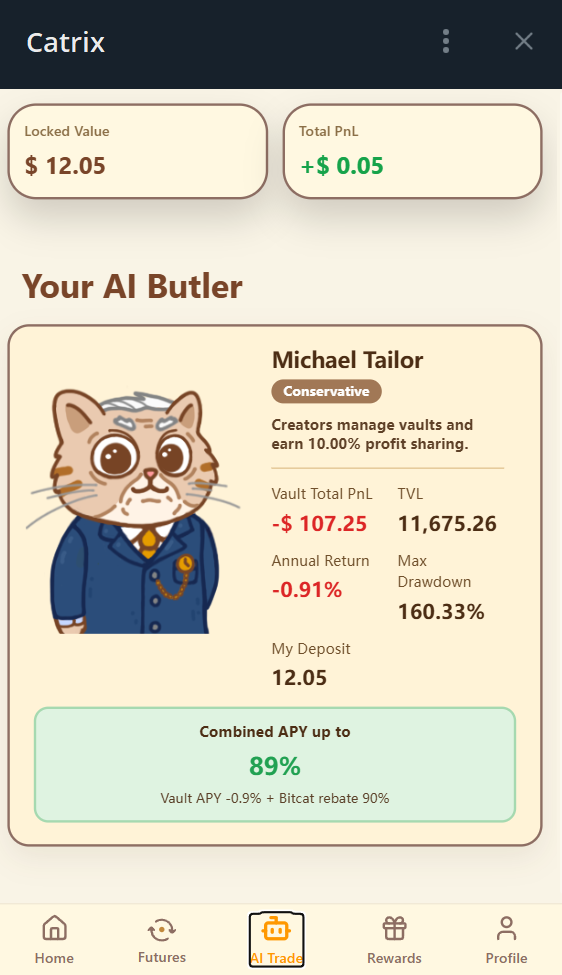

- Deposit USDT into a vault

- Have an AI Agent (“AI Butler”) execute real perpetual trades

- Track live vault metrics including PnL, APY, and drawdown

- Potentially earn $Bitcat rebate incentives

Importantly, trades are reportedly executed on Hyperliquid, meaning capital is interacting with real market liquidity rather than simulated returns.

That distinction matters.

Addressing the Skepticism: Is Catrix Sustainable?

It’s fair to acknowledge that some early Telegram-native projects were speculative experiments that faded quickly. Skepticism toward mini-app ecosystems is understandable.

However, Catrix operates within Telegram’s official monetization framework.

As a public Telegram channel, it participates in Telegram’s ad revenue share model, under which channel owners receive 50% of advertising revenue paid in TON.

With approximately 200,000 subscribers, conservative CPM modeling suggests:

- Potential monthly ad revenue in the low-to-mid four figures (conservative estimate)

- Possibly higher depending on engagement and impressions

- Annualized revenue potentially reaching mid-five figures even without sponsorship deals

While advertising alone would not define long-term platform viability, it meaningfully challenges the “zero-revenue” assumption often attached to early-stage crypto communities.

More importantly:

Around 55% of token allocation is reportedly designated to the community.

If revenue and incentive alignment continue, the economic structure appears more iterative than extractive.

That doesn’t eliminate risk — but it changes the narrative.

The Core Question: Why Does the AI Vault Matter for $Bitcat?

Let’s get practical.

If future $Bitcat distribution mechanisms incorporate ecosystem participation metrics such as:

- Vault deposits

- Trading volume

- Referral engagement

- Active protocol interaction

Then passive holders may be structurally disadvantaged relative to active participants.

Catrix currently advertises:

- AI Butler operating 24/7

- Live perpetual strategy execution

- Real-time vault transparency

- “90%+ $Bitcat rebate APY”

- Referral bonus incentives

It’s critical to clarify:

The “90%+ APY” refers to rebate incentives, not guaranteed market trading returns.

User returns may consist of:

- Vault trading performance

- $Bitcat rebate layer

That distinction is essential for credibility.

Why This Timing Is Interesting (Perp DEX Cycle Context)

We are currently in a heavy perpetual trading cycle. Across the market, many retail traders are experiencing liquidation events or consistent drawdowns due to:

- Emotional entries

- Over-leverage

- FOMO-driven position sizing

- Inconsistent risk management

The AI Vault offers a structurally different approach:

- Pooled capital

- Algorithmic execution

- Reduced emotional bias

- Programmatic allocation

It does not eliminate risk.

It does not guarantee returns.

But it replaces discretionary trading behavior with systematic exposure.

For users who believe in Bitcat’s future incentives, this may offer a more capital-efficient method of staying ecosystem-aligned compared to manual speculation.

Early Anecdotal Observation

In a small personal allocation of $12, vault performance showed a +$0.05 unrealized gain within six hours.

This is far too early to draw conclusions, but it demonstrates:

- Capital is actively deployed

- PnL fluctuates in real time

- Even small deposits are engaged

The more important takeaway isn’t short-term profit — it’s participation.

Strategic Framing for Early Cattea Users

If you’ve been here since the Cattea game era, your real decision isn’t:

“Will I make money immediately?”

It’s:

“Which action best positions me for long-term ecosystem upside?”

From a strategic standpoint, AI Vault participation currently provides:

- Active capital deployment

- Transparent performance metrics

- Ecosystem engagement signal

- $Bitcat rebate exposure

- Referral amplification potential

Relative to simply holding or remaining inactive, vault engagement may create a stronger participation footprint — if allocation frameworks ultimately reward activity.

How to Access the Catrix AI Vault

If you want to explore the AI Butler and monitor live vault performance yourself, you can access the official Catrix trading interface here:

👉 Start Catrix AI Vault:

https://t.me/CatteaAIbot/tradeapp

The Bigger Picture

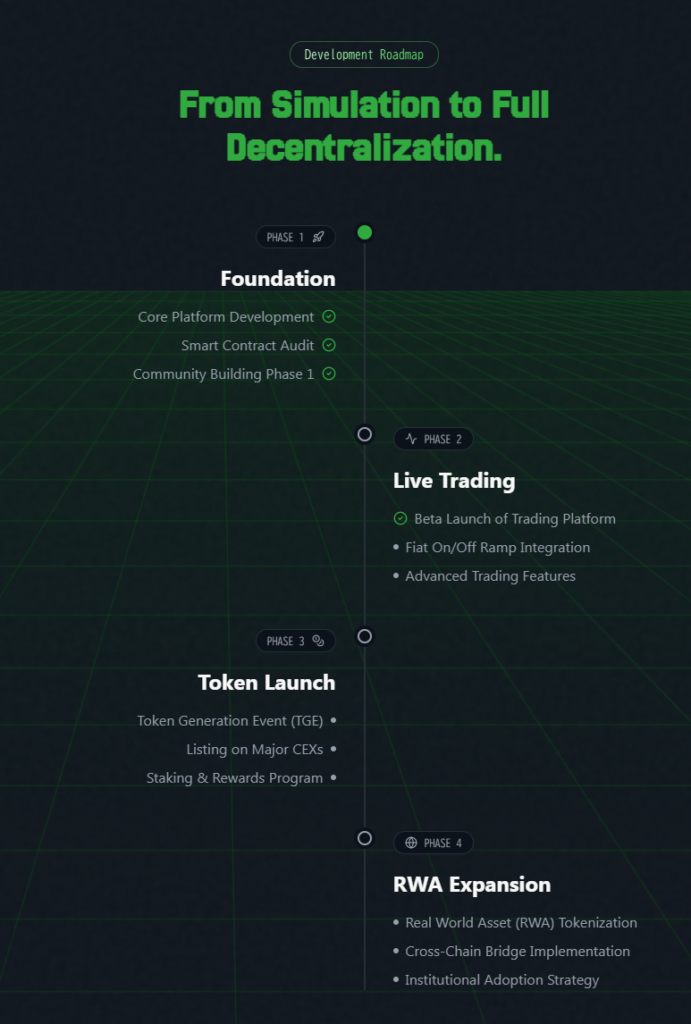

Catrix represents three structural shifts:

- From game points → financial infrastructure

- From passive participation → capital-backed engagement

- From isolated mini-app → revenue-integrated Telegram-native ecosystem

Skepticism is healthy in crypto.

But scale, monetization structure, and execution integration matter.

Catrix is no longer just a game.

It is positioning itself at the intersection of:

- AI-managed derivatives

- Telegram-native monetization

- Incentive-aligned token distribution

- Hyperliquid market execution

For early Cattea participants evaluating their next move, the AI Vault may represent a capital-efficient method of remaining ecosystem-aligned — particularly for those focused on optimizing potential $Bitcat positioning while avoiding the emotional volatility of manual perpetual trading.

No guarantees.

But structurally, it’s a more active approach than standing still.

コメント